Expand to Amazon Spain! US sellers, learn to assess demand, handle VAT, EORI, and EPR compliance for a successful European e-commerce launch.

How to Expand to Amazon Spain: A Step-by-Step Guide for US Sellers

With over 35 million online shoppers and a rapidly growing e-commerce market projected to exceed €65 billion in 2025, Amazon Spain is a strategic entry point for U.S. sellers looking to expand across Europe.

However, selling in Spain isn’t a copy-paste of your U.S. playbook. You’ll need to navigate EU tax laws and product compliance, write Spanish listings, and handle fulfillment for your new customers.

This guide walks you through everything you need to enter the Spanish market with confidence. From VAT registration to creating high-converting listings, so you can scale your business the right way from day one.

Step 1: Evaluate Demand in Amazon Spain

Before expanding your business to Amazon Spain, you need to answer one simple question: “Is there real demand for your product in Spain?”

Spain’s marketplace may be less saturated than the UK or Germany, but that doesn’t guarantee sales. You need proof that there’s enough demand for your product to justify the cost of setting up on Amazon Spain.

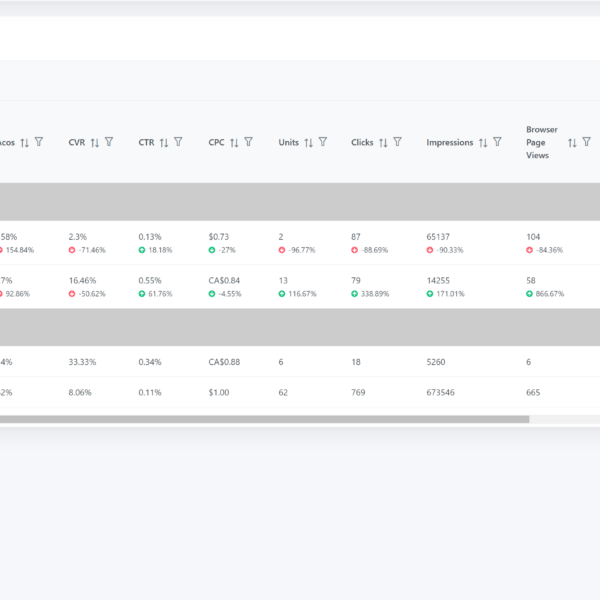

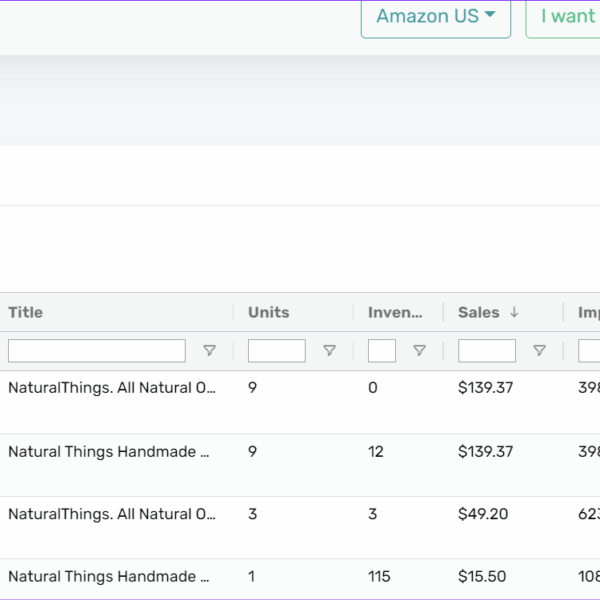

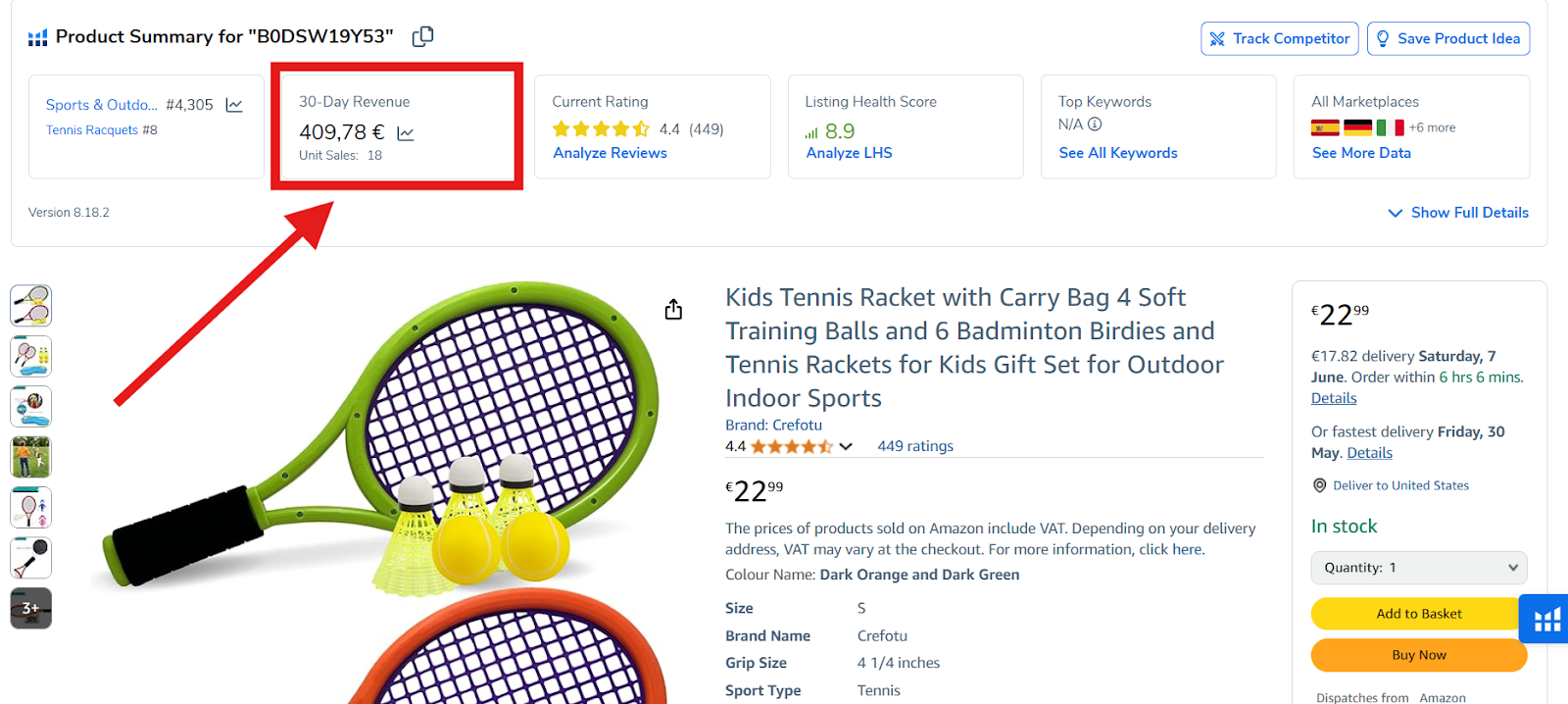

To check demand, start by installing the Helium 10 X-Ray Chrome extension. It’ll help you analyze the sales performance of products in your category.

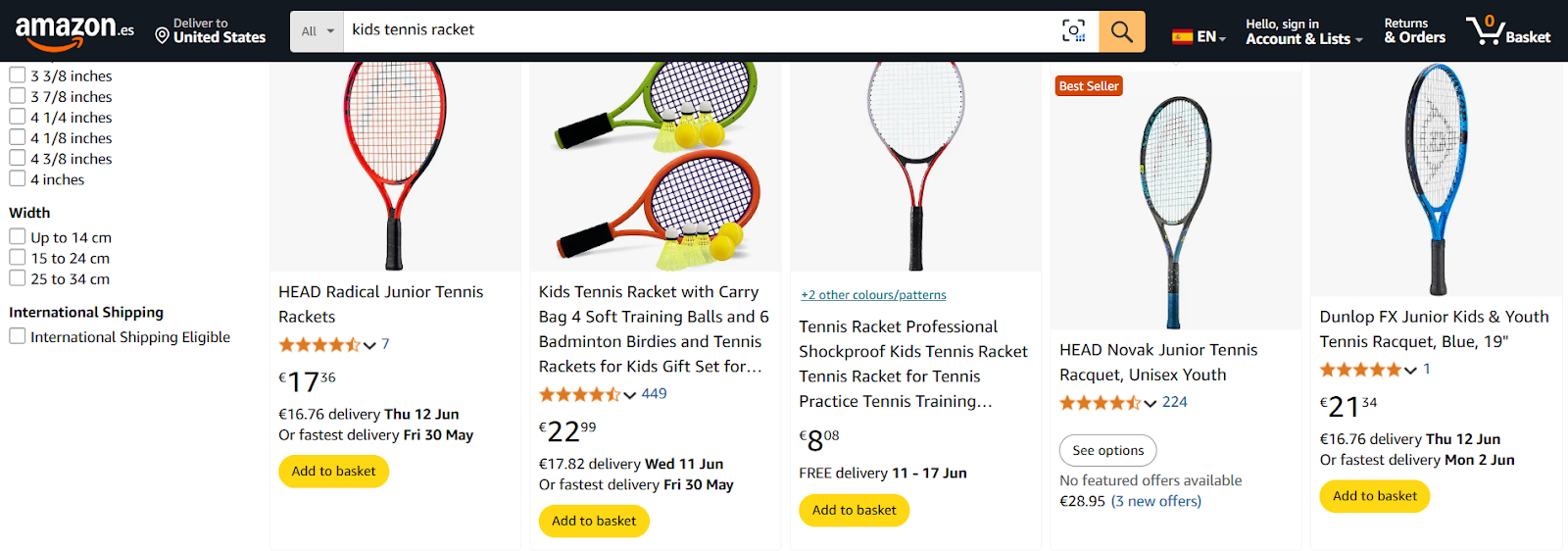

Next, go to Amazon.es and enter your product’s main keyword (e.g., “kids tennis racket”) in the search bar.

Click on the first 10 listings ranking organically for that keyword to see your top competitors’ monthly sales volume.

Ideally, you want to see several listings in your niche selling 500 to 1,000 units per month. That’s a healthy sign of demand.

However, if most listings sell fewer than 100 units per month, the niche may not be worth pursuing in Amazon Spain.

Step 2: Prepare for Spanish and EU Compliance

To launch and operate legally in Spain, adhering to the EU’s tax, import, and product compliance regulations is important.

Here’s a breakdown of what you need to avoid penalties:

1. Value Added Tax (VAT) Registration

If you plan to store goods in Spain or your annual sales to Spanish consumers exceed €10,000, you need to register for Spanish VAT. As a US seller, this process includes:

- Appointing a Fiscal Representative: Non-EU sellers must designate a fiscal representative in Spain who is jointly liable for VAT obligations.

- Obtaining a Spanish VAT Number: This number is necessary for invoicing and tax reporting purposes. You can apply for a VAT number via the Spanish Tax Agency (Agencia Tributaria) or work with a VAT service provider like Avalara or Hellotax.

2. Economic Operators Registration and Identification (EORI) Number

An EORI number allows you to legally import goods through EU customs and is required for filing declarations and paying import VAT.

You can apply for it through the Spanish customs authorities (Agencia Tributaria) or let your customs broker handle the application. Some VAT service providers also include EORI setup in their onboarding.

3. Extended Producer Responsibility (EPR) Compliance

Spain enforces EPR regulations that hold sellers accountable for the recycling of packaging and other specific product parts.

If you sell any product with packaging to Spanish consumers, you are required to:

- Register with a Producer Responsibility Organization (PRO) such as Ecoembes, which manages household packaging waste.

- Register with the Spanish Packaging Registry (Registro de Productores de Producto). After registering, you’ll receive a unique EPR registration number (e.g., ENV/SP/XXXXXXX) that must be included in your documentation and invoices.

Once registered, you’ll need to:

- Submit annual reports on the weight and material type of packaging placed on the Spanish market.

- Pay an eco-contribution fee, calculated by your PRO based on your reported volumes and packaging types.

Additionally, if you sell electronics, batteries, or electrical equipment, you may need to register with a specialized PRO such as ERP España, ECOLEC, or Ecoasimelec, depending on your product category.

Note: Amazon requires proof of EPR compliance for affected categories. If you don’t provide it, they may suspend your listings or automatically enroll you in their Pay-on-Behalf (PoB) program, which includes compliance fees plus Amazon admin charges.

If you’re unsure whether your product is covered by EPR obligations, check the Amazon EU product compliance guidelines inside Seller Central.

4. Product Compliance & Labeling

Some product categories have additional safety and labeling requirements under EU law.

- CE Marking: Products such as electronics, toys, and medical devices require CE marking, indicating conformity with EU safety standards.

- Authorized Representative: Non-EU sellers must appoint an EU-based authorized representative for CE-marked products.

- Labeling Requirements: Product labels must be in Spanish and include necessary information such as usage instructions, safety warnings, manufacturer details, and instructions for disposal and recycling.

5. Import Duties and Customs Declarations

When importing goods into Spain, you must:

- Submit Accurate Customs Declarations: Every shipment into Spain must be declared to Spanish Customs (Aduanas). You or your customs broker will need to:

- Clearly state the product description, HS code, value, and country of origin

- Include your EORI number and Spanish VAT number

- Submit documentation through Spain’s DUA (Documento Único Administrativo) system

Incorrect or incomplete declarations can lead to delays, fines, or seizure of goods.

- Pay Import Duties: Rates are calculated based on product category (via HS code), declared customs value (CIF = Cost + Insurance + Freight), and applicable EU tariffs (check via the TARIC database).

If this process seems complicated, it’s worth working with a customs broker or freight forwarder who understands EU import rules. Many VAT service providers also offer customs clearance packages.

Step 3: Set Up Your Amazon Spain Seller Account

Once your VAT, EORI, and compliance obligations are in motion, the next step is to set up your Amazon Spain seller account.

Fortunately, Amazon makes this easy through its Global Selling infrastructure, but there are still a few specific things U.S. sellers must do to get verified and fully operational in the Spanish marketplace.

1. Link Your US and European Seller Accounts

Amazon allows you to link your existing U.S. account with EU marketplaces, including Spain. To link your accounts:

- Log in to Seller Central and go to the Global Selling section

- Under “Amazon Stores Worldwide,” go to Spain and click “Link Account”

Once linked, you’ll be able to switch between marketplaces from one unified dashboard and manage inventory, ads, and listings in the Spanish marketplace.

2. Complete Spain-Specific Seller Verification

Even after linking accounts, Amazon Spain requires additional Know Your Customer (KYC) documentation to comply with EU regulations.

Here’s what you’ll need to submit:

- Bank Account Details: Your account must be able to receive EUR payouts. Many U.S. sellers use Payoneer or Wise Business to accept payments in euros with low conversion fees.

- VAT Information: Amazon will request your VAT number and may validate it through the VIES (VAT Information Exchange System). If you’re already registered for Spanish VAT (covered in Step 2), simply enter your VAT number.

- Business Address Verification: You may be required to upload proof of your company’s registered address. Acceptable documents include utility bills, bank statements, or business registration certificates issued within the past 180 days.

- Identity Verification: Submit clear, high-resolution scans of a valid government-issued ID (passport or driver’s license) for the account owner or authorized representative.

Note: Amazon may request that documents be translated into Spanish, especially if they’re reviewing them manually.

3. Choose Your Selling Plan

Amazon Spain offers two main selling plans:

- Individual Plan: No monthly fee, but you pay a per-item fee of €0.99 per sale. It is suitable for those testing new markets.

- Professional Plan: This plan has a €39/month fixed subscription fee and gives you access to bulk listing tools, advertising, and international features like Pan-EU FBA.

| Plan | Monthly Fee | Best For |

| Individual Plan | €0.99 per item sold | Testing the market |

| Professional Plan | €39/month flat fee | Scaling up and unlocking access to advanced features |

Since you’re already selling on Amazon, the Professional Plan is the clear choice for your expansion to Spain.

Step 4: Create Optimized Product Listings for Amazon Spain

Selling on Amazon Spain isn’t just about translating your U.S. listings into Spanish. To succeed, you need to localize your listing content so it connects with Spanish shoppers and ranks in relevant search results.

Here’s how to do it right:

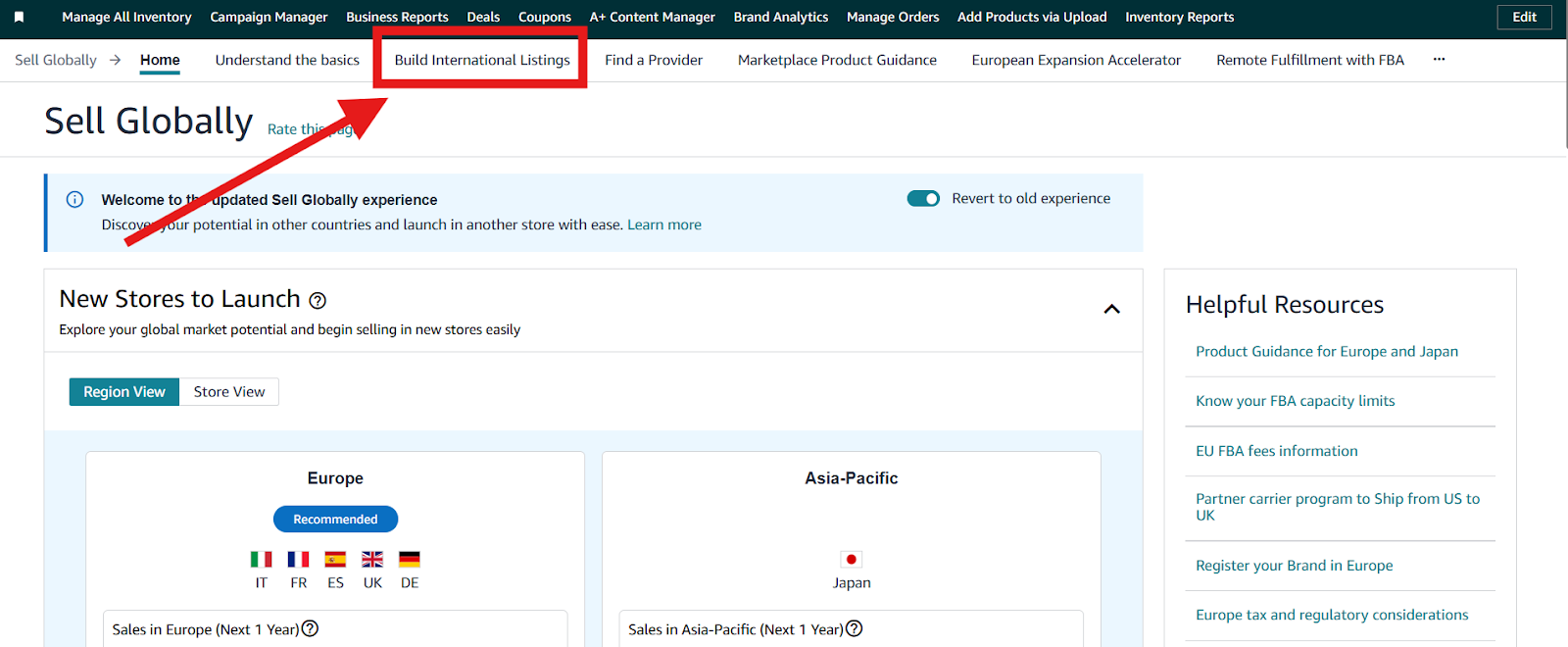

1. Transfer Listings Using Build International Listings (BIL)

If you already have optimized U.S. listings, you can use Amazon’s Build International Listings (BIL) tool to transfer them to Amazon Spain.

To use it:

Go to “Seller Central” > “Inventory” > “Sell Globally” > “Build International Listings.”

Next, choose your US marketplace as the source, and Spain as the target.

BIL copies your listings and adjusts prices based on currency differences.

For example, if your U.S. price is $50, BIL may list it at around €60.50 on Amazon Spain (based on currency conversion plus 21% VAT).

2. Localize Your Listing

While BIL converts your listing content to Spanish, to rank well and convert shoppers, you need to manually localize your listing. Here’s what to focus on:

- Language: Translate your title, bullets, and product description into native-level Spanish. If possible, work with a Spanish copywriter or a professional translator, not Google Translate.

- Product Dimensions: Use metric units only. Convert inches to Centímetros (cm) and pounds to Kilogramos (kg) or gramos (g).

- Regulatory Statements: For categories like electronics, toys, and supplements, add compliance notes in Spanish.

3. Conduct Spain-Specific Keyword Research

Spanish shoppers don’t always search the same way U.S. customers do, so relying on English keywords may limit your visibility.

Instead, use tools like Helium 10 or Jungle Scout to discover high-volume Spanish keywords relevant to your products and incorporate them in your listings.

Additionally, check the suggestions given when you use the search bar on Amazon.es and check best-seller listings in your category to see which keywords they are using.

4. Optimize Backend Search Terms

In the “Search Terms” field on your Spanish listing’s backend:

- Use Spanish synonyms and related phrases

- Avoid repeating words already used in your title or bullets

- Don’t include commas, quotes, or brand names

For example, if you’re selling a lunch bag, backend terms might include:

bolsa comida lonchera porta alimentos térmica comida escolar

Step 5: Plan Your Fulfillment and Shipping

Once your listings are live, the next big decision is how to fulfill your orders. Amazon offers sellers multiple fulfillment options, and choosing the right one will impact your delivery speed, profit margins, and scalability across Europe.

Option 1: Fulfillment by Amazon (FBA Spain)

FBA allows you to send inventory to an Amazon fulfillment center in Spain while Amazon handles storage and order shipping.

This is the most popular option for international sellers and often the easiest way to win the Buy Box and get the Prime badge.

Why Choose FBA Spain:

- Your products are Prime-eligible, increasing your visibility and Click-Through Rate.

- Faster delivery to Spanish customers with local shipping.

What You Need to Handle:

- Import & Customs: You are responsible for customs clearance and import VAT.

- Shipping Inventory to Spain: You’ll need to create a shipping plan and cover the cost of sending inventory to an Amazon warehouse in Spain.

- Fulfillment & Storage Fees: Amazon charges you for keeping your goods in a Spanish fulfilment center. You can use the Amazon FBA Revenue Calculator to estimate your fulfillment and storage fees based on product size and weight.

Option 2: Pan-European FBA (Pan-EU FBA)

If you plan to sell across multiple EU marketplaces, Pan-European FBA is a powerful way to scale.

Just like FBA, you send inventory to an Amazon fulfillment center in any EU country but in this case, Amazon automatically redistributes your products across other European warehouses based on demand.

This means customers in Germany receive local delivery, even if you only shipped inventory directly to Spain.

Why Choose Pan-EU FBA:

- Faster shipping across all major EU countries, not just Spain.

- Reduced cross-border delivery fees within Europe.

- Local Prime eligibility in each country where inventory is stored.

What You Need to Handle:

- VAT registration in every country where Amazon stores your inventory.

- Environmental compliance and product labeling to meet each country’s standards.

3. Fulfillment by Merchant (FBM)

With FBM, you store and ship the products yourself or through a third-party logistics service. This option gives you complete control over the fulfillment process but requires more effort.

Why Choose FBA Spain:

- You can customize your products’ packaging.

- Storing bulky or slow-moving products yourself can reduce FBA fees.

What You Need to Handle:

- Customs, import VAT, and delivery to Spanish customers.

- Partnership with a reliable EU carrier like DHL, UPS, or Correos.

| Feature | FBA | Pan-European FBA | FBM |

| Prime Eligibility | Yes | Yes | No |

| Shipping to Customer | Amazon | Amazon | Seller |

| Upfront Cost | Medium | High (multi-VAT) | Low |

| Scalability | High | Very High | Moderate |

| Best For | Scaling in Spain | Scaling across the EU | Custom products |

If you’re just entering Spain, we recommend starting with FBA Spain. Once your sales pick up, you can activate Pan-EU FBA to expand to France, Italy, and Germany without having to manage each marketplace separately.

Conclusion

Expanding to Amazon Spain is a smart move for U.S. sellers looking to grow their brand in Europe’s rising markets. With millions of active shoppers and less competition compared to the UK and Germany, Spain offers a real opportunity if you launch with the right foundations.

This guide has shown you exactly how to launch on Amazon.es. Now, it’s time to move from learning to setup, then sales. Amazon Spain is ready. Are you?